Renters Insurance in and around Lafayette

Your renters insurance search is over, Lafayette

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - furnishings, parking options, location, house or townhome? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Your renters insurance search is over, Lafayette

Coverage for what's yours, in your rented home

Agent Gina Kornafel, At Your Service

When the unpredicted burglary happens to your rented condo or space, generally it affects your personal belongings, such as a coffee maker, a bicycle or a desk. That's where your renters insurance comes in. State Farm agent Gina Kornafel is passionate about helping you choose the right policy so that you can protect your belongings.

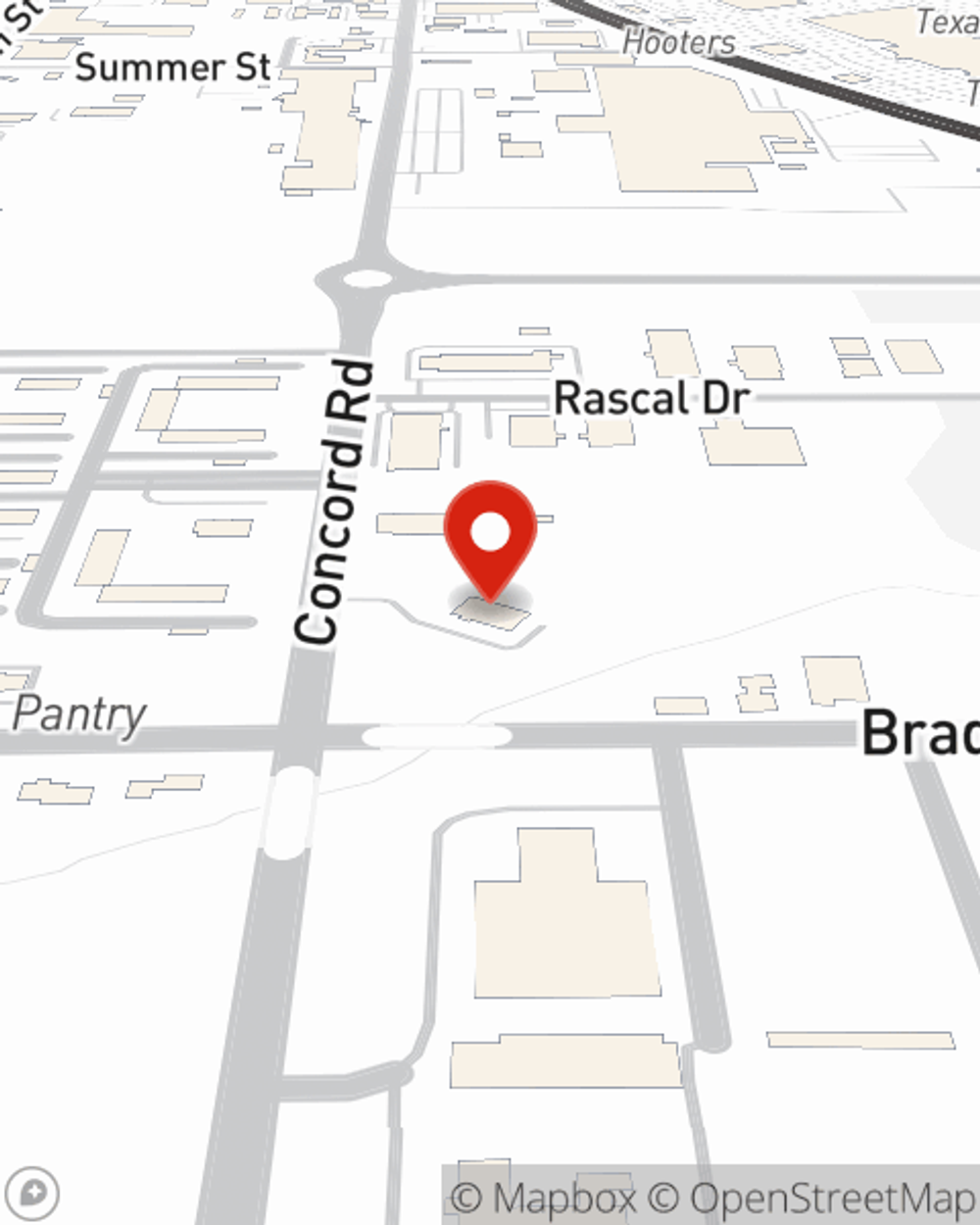

Contact State Farm Agent Gina Kornafel today to discover how a State Farm policy can protect items in your home here in Lafayette, IN.

Have More Questions About Renters Insurance?

Call Gina at (765) 448-4999 or visit our FAQ page.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Gina Kornafel

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.